A powerful story of growth.

A long history supporting critical infrastructure that stands the test of time

CRH was formed through a merger in 1970 of two leading Irish public companies, Cement Limited (established 1936) and Roadstone Limited (established 1949).

See how our story has unfolded over the decades and how our business strategy has enabled our growth, from a national Irish company in 1970 to the leader we are today.

Scroll to Explore

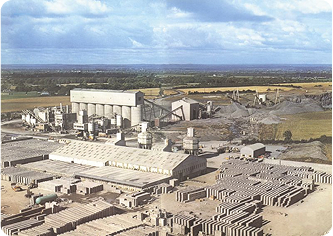

1970s – Foundations of CRH

The 1970s was a decade of new beginnings for CRH, which laid the foundations for our success. In 1970, the Company had sales of approximately $50 million, of which 95% was in Ireland. By 1979, it had grown to over $600 million of annual sales and was operating in four countries.

1980s – Pursuing our Growth Strategy

Demonstrating the resilience of its business model, CRH pursued a clear strategy for growth, establishing a new platform in the US and further expansion across Europe.

1981

The Utility Vault acquisition significantly expanded CRH’s precast concrete operations in Western US markets and formed the basis of what is now our Oldcastle Infrastructure business, an industry leader in engineered building solutions.

1985

CRH established a new Building Materials platform in the US through the acquisition of Callanan Industries, an aggregates and asphalt company in New York.

1990s – Expansion on All Fronts

1995

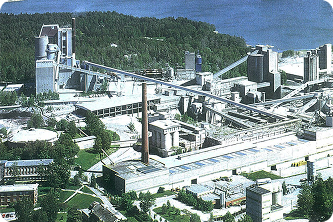

Since 1938, the Company’s cement activities had been solely in Ireland. By acquiring a shareholding in Cement Ożarów, one of the leading Polish cement producers, CRH began to widen its cement production footprint.

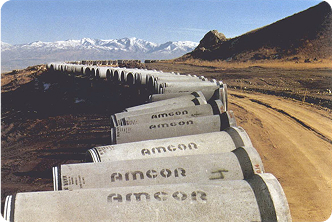

In the same year, the Company established a new growth area for the Building Materials portfolio with the acquisition of Staker Parson, a major aggregates and asphalt business in Utah and the other Mountain States.

1999

Approaching its 30th anniversary, CRH continued its expansion into the US Midwestern materials market with the acquisition of Thompson-McCully, the leading aggregates and asphalt manufacturer in southern Michigan. In Europe, CRH entered cement in the Ukraine and strengthened its position in concrete and aggregates in Poland. It also purchased Finnsementti and Lohja Rudus gaining a leading market position in cement, aggregates and concrete products in Finland and a presence in the Baltic region for the first time.

1997

The acquisition of Permacon provided a foothold in the Canadian architectural products market plus a welcome introduction to professionally installed hardscapes, which would in time become CRH’s successful Belgard brand. Permacon remains a key CRH R&D centre for the development of new products and product styles in architectural masonry.

2010s – Reshaping for Growth

Active portfolio management took center stage in the 2010s as CRH recycled capital and repositioned for growth.

2015

CRH entered the top three in building materials globally with the acquisition of a portfolio of assets from Lafarge-Holcim for an enterprise value of $7.2 billion. The deal doubled CRH’s cement volume and expanded the Company’s cement, aggregates and readymixed concrete portfolio.

2018

The divestment of the US Distribution business at a high multiple provided the opportunity to recycle the proceeds into higher growth areas, and shortly after CRH acquired Ash Grove Cement Company in the US for a total consideration of $3.5 billion, complementing its cement portfolio. Now, CRH was a top five cement producer in North America, with operations across Florida, Texas, the Midwest and Western US, and Canada.

2020s – 50 Years & NYSE Listing

CRH continued to transform from a sole supplier of base materials to a fully connected provider of value-added products and integrated building solutions.

2025 – Planning for the Future

CRH has become the leading compounder of capital in our industry, with a relentless focus on growth at every level of the organization.

We are a best-in-class operator, unrivaled in size and scale, and our connected portfolio has set the Company up for success, with a significant runway of growth opportunities to pursue in the coming years, to continue delivering industry leading value creation for our stakeholders.

Be a part of our future, because together, we’re building what’s next